Introduction

The semiconductor industry, pivotal to technological evolution over the past seven decades, is now evolving at an accelerated pace driven by electrification, digitisation, artificial intelligence (AI), and the Internet of Things (IoT). This growth is fueling demand across computing, automotive, industrial automation, and consumer electronics sectors. According to PwC’s State of the Semiconductor Industry Report, the global semiconductor market revenue was projected to reach USD 642 billion in 2024, with expectations to surpass USD 1 trillion by 2030, propelled by advancements in logic and memory components as well as automotive semiconductors.

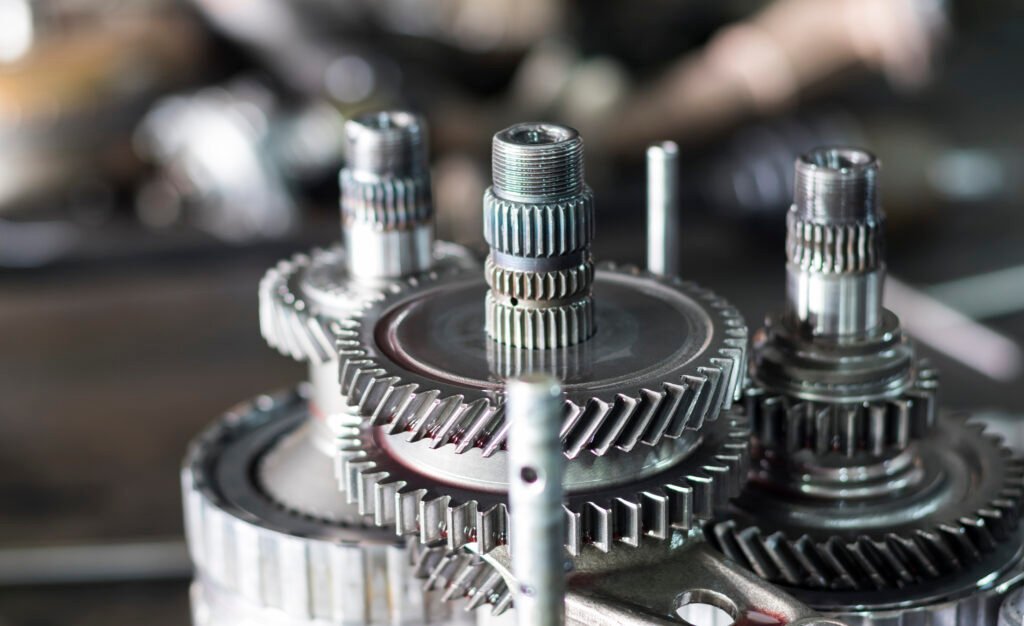

Amid this expansion, the precision and reliability of gearboxes used in semiconductor manufacturing equipment have become increasingly critical. Gearbox manufacturing technologies must keep pace with the semiconductor sector’s rigorous demands for accuracy, efficiency, and durability to facilitate wafer fabrication, assembly, and testing processes. This article delves into the semiconductor industry’s growth outlook, emerging manufacturing trends, and the vital role advanced gearbox production plays in supporting this dynamic ecosystem.

Semiconductor Industry Outlook: Growth and Drivers

The semiconductor industry is expected to maintain robust growth through 2025 and beyond. The World Semiconductor Trade Statistics (WSTS) organisation forecasts an 11.2% growth in 2025, reaching a total market valuation of approximately USD 700.9 billion. Growth is primarily driven by continuing demand for logic and memory chips essential for AI, cloud infrastructure, and consumer electronics. Segments like analog and sensors also show moderate gains, while discrete semiconductors and optoelectronics display slight contractions due to trade tensions and supply chain disruptions.

Regionally, the Americas and Asia-Pacific lead growth with projected rates of 18.0% and 9.8%, respectively, whereas Japan and Europe show more moderate expansions [WSTS, 2025]. According to Deloitte’s 2025 semiconductor industry outlook, sales could reach USD 697 billion in 2025, on track to hit USD 1 trillion by 2030, marking a compound annual growth rate (CAGR) of 7.5% over the period.

The automotive sector stands out, expected to grow at a CAGR of nearly 10% from 2024 to 2030, fueled by increasing electric vehicle (EV) adoption, which demands components with higher semiconductor content compared to traditional vehicles. EVs incorporate power electronics and battery management systems that rely on highly reliable gearboxes integrated into manufacturing machinery, further linking gearbox advancements to semiconductor growth.

Role of Gearboxes in Semiconductor Manufacturing

Precision gearboxes are core components in semiconductor manufacturing equipment such as lithography machines, wafer handling robots, and packaging systems. These gearboxes are required to provide:

Advances in gearbox manufacturing focus on improving materials, machining precision, and assembly techniques to meet these demands. For example, cutting-edge CNC machining, high-precision grinding, and gear tooth profile optimisation contribute to gearbox quality suitable for semiconductor equipment exposed to stringent conditions.

Moreover, the drive towards Industry 4.0 integration in gearbox manufacturing—incorporating real-time condition monitoring, digital twins, and AI-based predictive maintenance—enhances operational reliability and lifecycle costs.

Trends in Semiconductor Gearbox Manufacturing

Precision Engineering and Materials

Manufacturers are adopting advanced alloys, composite materials, and hardened coatings to enhance gearbox durability and reduce wear. Ultra-precision machining techniques minimise surface roughness and profile deviations, key to ensuring repeatability and reduced downtime in fabrication systems.

Digitalisation and Smart Manufacturing

Industry 4.0 technologies enable digital twins of gearboxes, simulating operational stresses and optimising design before physical manufacturing. This reduces prototyping time and yields better-performing gearboxes suited for semiconductor fabrication demands. Integrated sensors provide continuous data streams, allowing proactive maintenance.

Miniaturisation and High-Speed Operation

With semiconductor machinery moving toward smaller footprints and faster cycle times, gearboxes must be compact yet capable of handling higher rotational speeds and dynamic loads. Research in micro-gears and hybrid systems addresses these challenges, pushing the boundaries of traditional gearbox design.

Market Outlook for Semiconductor Assembly and Packaging Equipment

The semiconductor assembly and packaging sector—which relies heavily on precision gearboxes for automation—is forecasted to grow strongly. According to Precedence Research, the global semiconductor assembly and packaging equipment market is expected to reach USD 31.78 billion by 2030, growing at a CAGR exceeding 8.5% from 2023 to 2030.

Innovations in packaging, including wafer-level packaging, 3D integration, and advanced chip stacking, impose new mechanical requirements on gearboxes embedded in assembly robots and pick-and-place machines. These growing demands highlight the necessity for continued advances in gearbox manufacturing technologies to keep pace with semiconductor equipment innovations.

Industry Perspectives and Strategic Priorities

Deloitte underscores the semiconductor industry’s continued shift toward software-defined vehicles and edge computing, which further amplifies the complexity and volume of semiconductor production, thereby influencing demand for high-performance manufacturing gearboxes.

Additionally, the industry grapples with geopolitical tensions and supply chain disruptions, prompting investments in localized production and resilient equipment design. Gearbox suppliers aligned with these priorities, offering cutting-edge precision and adaptive manufacturing workflows, position themselves favorably in the semiconductor equipment ecosystem.

Conclusion

The evolving semiconductor industry—propelled by AI, EVs, and digital infrastructure—is on a trajectory for continued rapid growth, with market size projections exceeding USD 700 billion in 2025 and approaching USD 1 trillion by 2030 as per PwC, WSTS, and Deloitte reports. This explosive expansion requires manufacturing processes underpinned by advanced precision gearboxes that guarantee reliability, accuracy, and efficiency in semiconductor production machinery.

Advancements in gearbox materials, manufacturing precision, and digital twin integrations strengthen the critical link between mechanical component manufacturing and semiconductor industry success. Concurrently, the booming assembly and packaging equipment sector underscores the urgent need for gearbox technologies that meet emerging application complexities.

As semiconductor production scales new heights, the synergy between semiconductor innovation and gearbox manufacturing will remain crucial, driving forward technological progress across global industries and enabling the digital transformation of our world.

References-

https://www.pwc.com/gx/en/industries/technology/state-of-the-semiconductor-industry-report.pdf

https://www.precedenceresearch.com/semiconductor-assembly-and-packaging-equipment-market

https://www.deloitte.com/us/en/insights/industry/technology/technology-media-telecom-outlooks/semiconductor-industry-outlook.html